Since 2009, capital gains have added $3 trillion to investment income each year, on average. Some assets, such as bonds, tend to generate income mostly in explicit payments, while other assets, such as stocks, tend to generate more income in capital gains.Ĭapital gains are a key form of investment income for U.S. 2 For instance, if an investor buys $100,000 of corporate stock and then sells it 1 year later for $110,000, then that $10,000 of income is a capital gain. The income resulting from these price increases is known as a capital gain. In addition to explicit payments and returns, investment income also includes increases in wealth that result from increases in the price of assets, such as increases in the price of stocks, bonds, real estate, or mutual fund shares. In contrast, shareholders in a traditional C corporation do not pay tax on the corporation’s profits. A pass-through business is one that “passes through” profits to its owners for tax purposes, who then pay income tax on those profits. Investment income is income generated by wealth, including interest on a bond, dividends paid on a corporate stock, rents from real estate, and profits from a pass-through business such as a partnership.

Taxing wealth by taxing investment income: An introduction to mark-to-market taxation What is investment income? Finally, it summarizes the distribution of the burden that would result, which would fall overwhelmingly on wealthy individuals. It then reviews the revenue potential of this approach to taxing investment income, explaining why a mark-to-market system can raise substantial revenues.

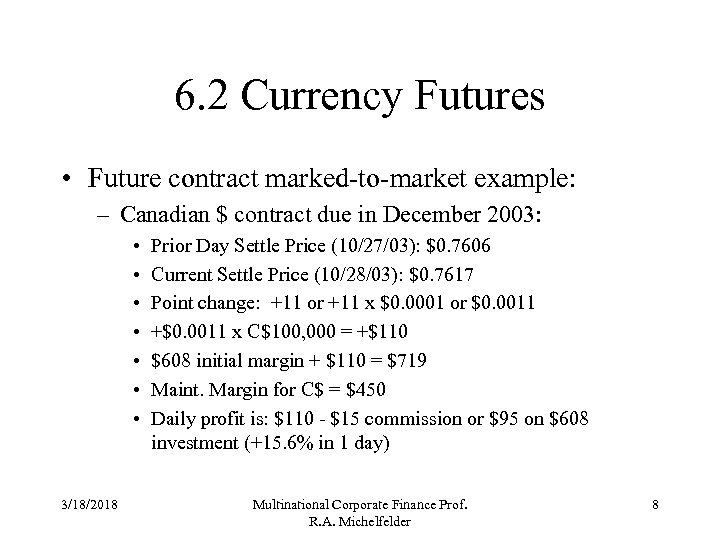

This issue brief first defines investment income and explains how mark-to-market taxation works. 1 In a system of mark-to-market taxation, investors pay tax on the increase in the value of their investments each year rather than deferring tax until those investments are sold, as they do under current law. This issue brief introduces mark-to-market taxation, one approach to raising taxes on wealth by reforming the taxation of investment income. wealth inequality in recent decades has spurred interest in increasing taxes on wealth. It is the same logic on each of the following days.The sharp increase in U.S. (The dividing by 400 is as we always do when calculating the gain or loss, because they are 3 month futures.)Īlternatively, if you prefer to use ticks, the deposit will have to be increased by 50 (contracts) x 8 (the change in ticks) x $25 (the tick value) = $10,000. On 2 June the price had fallen by 0.08% (95.84 – 95.76) and therefore the deposit would have to be increased by 50 (contracts) x $1,000,000 (contract size) x 0.08/400 (change in price) = $10,000 In this question, the futures were bought on 1 June. If the futures are gaining then the deposit can be reduced.

Each day, if the futures are losing money then the margin has to be increased. While the deal is open, the price of the futures changes from day to day.

Marked to market free#

As I explain in my free lectures, when a futures deal is started then a deposit (known as the margin) has to be paid to the broker (which is returned when the deal is closed, together with any gain or less any loss on the future).

0 kommentar(er)

0 kommentar(er)